Pradhan Mantri MUDRA Yojana (PMMY)

Micro Units Development and Refinance Agency Ltd. [MUDRA] is an NBFC supporting development of micro enterprise sector in the country. MUDRA provides refinance support to Banks / MFIs for lending to micro units having loan requirement upto 10 lakh. MUDRA provides refinance to micro business under the Scheme of Pradhan Mantri MUDRA Yojana.

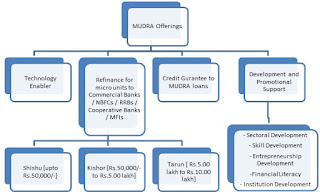

The other products are for development support to the sector. The bouquet of offerings of MUDRA is depicted below. The offerings are being targeted across the spectrum of beneficiary segments.

Micro Units Development and Refinance Agency Ltd. [MUDRA] is an NBFC supporting development of micro enterprise sector in the country. MUDRA provides refinance support to Banks / MFIs for lending to micro units having loan requirement upto 10 lakh. MUDRA provides refinance to micro business under the Scheme of Pradhan Mantri MUDRA Yojana.

The other products are for development support to the sector. The bouquet of offerings of MUDRA is depicted below. The offerings are being targeted across the spectrum of beneficiary segments.

Under the aegis of Pradhan Mantri Mudra Yojana (PMMY), MUDRA has created products / schemes. The interventions have been named 'Shishu', 'Kishor' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth to look forward to :

- Shishu : covering loans upto 50,000/-

- Kishor : covering loans above 50,000/- and upto 5 lakh

- Tarun : covering loans above 5 lakh and upto 10 lakh

It would be ensured that more focus is given to Shishu Category Units and then Kishor and Tarun Categories.

Within the framework and overall objective of development and growth of micro enterprises sector under Shishu, Kishor and Tarun, the products being offered by MUDRA are so designed, to meet requirements of different sectors / business activities as well as business / entrepreneur segments.

The funding support from MUDRA are of four types :

- Micro Credit Scheme (MCS) for loans upto 1 lakh finance through MFIs.

- Refinance Scheme for Commercial Banks / Regional Rural Banks (RRBs) / Scheduled Co-operative Banks

- Women Enterprise programme

- Securitization of loan portfolio

-

Micro Credit Scheme is offered mainly through Micro Finance Institutions (MFIs), which deliver the credit upto Rs.1 lakh, for various micro enterprise activities. Although, the mode of delivery may be through groups like SHGs/JLGs, the loans are given to the individuals for specific income generating micro enterprise activity. The MFIs for availing financial support need to enroll with MUDRA by complying to some of the requirements as notified by MUDRA, from time to time.

Different banks like Commercial Banks, Regional Rural Banks and Scheduled Cooperative Banks are eligible to avail of refinance support from MUDRA for financing micro enterprise activities. The refinance is available for term loan and working capital loans, upto an amount of 10 lakh per unit. The eligible banks, who have enrolled with MUDRA by complying to the requirements as notified, can avail of refinance from MUDRA for the loan issued under Shishu, Kishor and Tarun categories.

In order to encourage women entrepreneurs the financing banks / MFIs may consider extending additional facilities, including interest reduction on their loan. At present, MUDRA extends a reduction of 25bps in its interest rates to MFIs / NBFCs, who are providing loans to women entrepreneurs.

MUDRA also supports Banks / NBFCs / MFIs for raising funds for financing micro enterprises by participating in securitization of their loan assets against micro enterprise portfolio, by providing second loss default guarantee, for credit enhancement and also participating in investment of Pass Through Certificate (PTCs) either as Senior or Junior investor.

Mudra loan is extended for a variety of purposes which provide income generation and employment creation. The loans are extended mainly for :

- (i) Business loan for Vendors, Traders, Shopkeepers and other Service Sector activities.

- (ii) Working capital loan through MUDRA Cards.

- (iii) Equipment Finance for Micro Units.

- (iv) Transport Vehicle loans.

Following is an illustrative list of the activities that can be covered under MUDRA loans:

Purchase of transport vehicles for goods and personal transport such as auto rickshaw, small goods transport vehicle, 3 wheelers, e-rickshaw, passenger cars, taxis, etc.

Saloons, beauty parlours, gymnasium, boutiques, tailoring shops, dry cleaning, cycle and motorcycle repair shop, DTP and Photocopying Facilities, Medicine Shops, Courier Agents, etc.

Activities such as papad making, achaar making, jam / jelly making, agricultural produce preservation at rural level, sweet shops, small service food stalls and day to day catering / canteen services, cold chain vehicles, cold storages, ice making units, ice cream making units, biscuit, bread and bun making, etc.

Handloom, powerloom, khadi activity, chikan work, zari and zardozi work, traditional embroidery and hand work, traditional dyeing and printing, apparel design, knitting, cotton ginning, computerized embroidery, stitching and other textile non garment products such as bags, vehicle accessories, furnishing accessories, etc.

Financial support for on lending to individuals for running their shops / trading & business activities / service enterprises and non-farm income generating activities with beneficiary loan size of upto 10 lakh per enterprise / borrower.

Setting up micro enterprises by purchasing necessary machinery / equipments with per beneficiary loan size of upto 10 lakh.

MUDRA Card is an innovative product which provides working capital facility as a cash credit arrangement. MUDRA Card is a debit card issued against the MUDRA loan account, for working capital portion of the loan. The borrower can make use of MUDRA Card in multiple withdrawal and credit, so as to manage the working capital limit in a most efficient manner and keep the interest burden minimum. MUDRA Card will also help in digitalization of MUDRA transactions and creating credit history for the borrower.

National Payment Corporation of India (NPCI) has given RuPay branding to MUDRA Card and also separate BIN / IIN for the same, by which credit history can be tracked.

MUDRA Card can be operated across the country for withdrawal of cash from any ATM / micro ATM and also make payment through any ‘Point of Sale’ machines.

The design of the MUDRA card as approved by DFS, GoI and NPCI is given below. Banks can customize the same by incorporating their logo and name.

Traditional financing in Indian context adopts an Asset Based lending approach with emphasis on collaterals. Micro units, most of the times, are unable to provide the comfort of collaterals. Hence MUDRA loans i.e. loans upto Rs.10 lakh, have been made collateral free, as per the RBI norms in this regard.

To mitigate the issue of collaterals, MUDRA is offering a Credit Guarantee Product. MUDRA Credit Guarantee is extended by creation of a Fund called “Credit Guarantee Fund for Micro Units” [CGFMU] and the scheme has been notified by GoI vide its notification dated April 18, 2016. Accordingly, all eligible micro loans sanctioned since April 08, 2015 is covered under the Scheme. The Scheme is being managed by National Credit Guarantee Trustee Company Ltd. [NCGTC], an agency promoted by the GOI.

Further, given the context of the industry /segment, since the individual loan sizes would expectedly be small and number of loans will be large, Mudra Credit Guarantee scheme provide a Portfolio Guarantee. Under this, Credit Guarantee or Risk Sharing is provided for a portfolio of homogenous loans instead of a Scheme for individual loan - by - loan guarantee. This is expected to create administrative efficiencies and increase receptiveness for the Credit Guarantee product. The Guarantee product is one of the key interventions proposed with the objective of bringing down the cost of funds for the end beneficiary to improve its creditworthiness.

The corpus proposed for the Credit Guarantee Scheme would be regularly augmented with a charge on the outstanding loans under refinance. The same would be utilized for providing first loss guarantee / credit enhancement for securitized portfolio loans, as discussed below.

Besides the credit constraints, the NCSBs face many non-credit challenges, like,

- Skill Development Gaps

- Knowledge Gaps

- Information Asymmetry

- Financial / Business Literacy

- Lack of growth orientation

To address these constraints, MUDRA will adopt a credit- plus approach and offer Developmental and Support services to the target audience. It will act as a market maker and build –up an ecosystem with capacities to deliver value in an efficient and sustainable manner.

Financial / business literacy or financial education can broadly be defined as 'providing familiarity with and understanding of financial market products, especially rewards and risks, in order to make informed choices.'

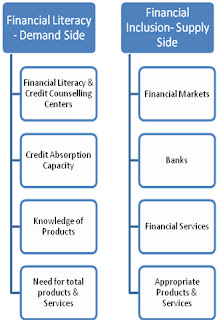

Financial Inclusion and Financial / business Literacy are twin pillars. While Financial Inclusion acts from supply side providing the financial market / services that people demand, Financial Literacy stimulates the demand side – making people aware of what they can demand. Supporting the financial literacy drive will contribute substantially from the demand side to the national agenda of financial inclusion.

This apart, the micro enterprise segment also needs business literacy which will help them in acquiring knowledge on running / managing business, keeping accounts, working out ratios, etc.

One of the major focus areas will be to formalize and institutionalize the last mile financiers / grass root institutions so that a new category of financial institutions viz. Small Business Finance Companies can be created and ecosystem developed for their growth.

Rural innovations at micro enterprise / unit level would also be one of the key areas for intervention and support. Support to Micro units by way of the facility of incubators would be taken up. This would ensure that at the most grass root levels in the country, there is climate for promotion of innovation as well as incubation of ideas from educated rural youths which would germinate in viable micro enterprises.

An enabling framework for support to "Small Business Finance Entities" would be created leading to formalization of the economy which is presently included in the informal sector.

Government of India has initiated several steps for encouraging enterprise creation in our country. The major one is “Make in India” movement. Make in India is a major national programme designed to facilitate investment, foster innovation, enhance skill development, project intellectual property and build best in class manufacturing infrastructure. This coupled with Start-up India and Stand-up India campaign, has created a conducive environment of enterprise creation in different scales. MUDRA, being an initiative for promoting micro enterprises, fits well with Make in India initiative for supporting these micro enterprises.

The National Rural Livelihoods Mission [NRLM] is set up "To reduce poverty by enabling the poor households to access gainful self-employment and skilled wage employment opportunities, resulting in appreciable improvement in their livelihoods on a sustainable basis, through building strong grassroots institutions of the poor." To achieve the above, NRLM Mission inter alia follows a demand driven strategy for continuous capacity building, imparting requisite skills and creating linkages with livelihood opportunities for the poor, including those emerging in the organized sector.

Similarly, the Deendayal Antodaya Yojana [DAY] National Urban Livelihood Mission is another progamme which is aimed at reducing Urban poverty through creation of micro enterprises, individually and group mode.

MUDRA, being an initiative for promoting micro enterprises, would make all efforts to draw synergies between NRLM, NULM and MUDRA interventions for supporting micro enterprises and creating sustainable livelihood opportunities for the poor.

NSDC is already engaged in the process of skill development at a National scale. Synergizing with NSDC will help MUDRA in augmenting the skill sets of the sectoral players.

With the growth of responsible lending practices, Credit Bureaus (CB) have gained increasing level of acceptability in the micro finance sector. The CB culture will help in creating credit history over a period of time which will facilitate faster credit dispensation as the system evolves.

Accreditation / rating of MFI entities is one of the roles earmarked for MUDRA. Further, a segment of financial intermediaries for the non corporate small business sector is envisaged to emerge in the financing architecture. MUDRA would work in coordination with Rating Agencies so that appropriate rating framework (s) which take into account sector specific features are devised for various sector participants. In the longer run, availability of rating for sector participants would facilitate formalization and further flow of capital to the sector.

Access to finance is critical and equally critical is the cost of finance to the NCSB/ultimate beneficiary. The funds mobilized by micro units from the informal sources are at a high cost. There is scope for cost rationalization. However, the rationalization is intricately linked with the cost of funds for the last mile MFIs.

GOI while announcing the formation of MUDRA also announced a refinance corpus for MUDRA at 20000 crores, to be allocated by RBI from the Priority Sector lending shortfall. Accordingly, RBI has provided the allocation which helps in bringing down the cost of lending at the ultimate borrower level as MUDRA refinance will reduce the average borrowing cost of the lending institutions

The NBFC-MFIs are presently regulated by Reserve Bank of India and RBI has already prescribed detailed guidelines for margin cap in respect of MFIs. The margin cap has been pegged at 10% for MFIs having loan portfolio of more than 100 crore and 12% for smaller MFIs having loan portfolio of less than 100 crore or 2.75 times the average base rate of five major commercial banks, whichever is less. In the backdrop of these guidelines and the fact that MFI sector has been constantly trying to reduce its costs, MUDRA would also help MFIs reduce their cost to bring down the overall cost to the end beneficiaries. Further, at the time of appraisal, MUDRA would be studying / assessing individual MFIs on this as well as other related parameters and suitably price its assistance based on such assessment.

In the case of Banks, RBI has also put a cap on the interest rate at Base rate/ MCLR for lending micro units by Commercial Banks by availing of MUDRA refinance. Similarly, the RRBs and Cooperatives have been given a interest cap of 3.50% over and above MUDRA refinance rate, while lending to MUDRA loan by availing of MUDRA refinance.

In case of NBFCs, RBI has also stipulated a interest cap of 6% over and above MUDRA refinance while their lending to MUDRA segment.

All these are expected to have a positive impact on the pricing of MUDRA loans in the country whereby the Micro enterprises will be able to avail of credit at a affordable interest rate. But, first and foremost objective is to ensure accessibility of credit.

No comments:

Post a Comment